So... what happens when the money supply changes? How does this affect things? That's what we're going to figure out today!

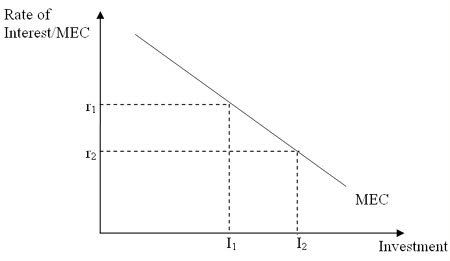

Remember the marginal efficiency of investment function?

There are two reasons why interest rates and desire for investment are negatively related

-lower interest rates mean that there is a lower opportunity cost for investing (it costs less to borrow money)

-when interest rates are lower, investing in capital becomes more attractive than keeping money in bonds (so if buying a new mixmaster will have a 4% yield, my friend the baker is much more likely to buy one when an equivalently-priced bond would only give him a 2% yield)

-Investment is determined by the REAL interest rate: for simplicity's sake, just assume that there is no inflation in this model for now

SO: There is an investment transmission mechanism

Let's do this in steps

1: The government changes the money supply (we'll learn how in the next little while)

2: The change in the money supply, thanks to the way the money market works, causes interest rates to fall (this is liquidity preference theory)

3: Lower interest rates cause investment to increase (this is marginal efficiency of investment theory)

4: Increased investment causes the family of aggregate expenditure curves for this economy to shift up

5: A shift up in aggregate expenditure causes aggregate demand to shift to the right, indicating an increasing in GDP, a decrease in unemployment, and an increase in the price level

BE SURE THAT YOU CAN REPRESENT EACH OF THESE STEPS GRAPHICALLY! If you have any questions about that, just send me an email and I will spell it out for you! =D

------------------------------

THERE IS ALSO AN EXCHANGE RATE TRANSMISSION EFFECT:

In open economies, consumers are not restricted to buying domestic bonds- they can also buy bonds sold by foreign governments. Thus, when the interest rate falls for one country in comparison with other countries, this makes that particular country's bonds less attractive for investors (if China's interest rate is 25% and Canada's is 4%, why the hell would you put your money in Canadian bonds [assuming the Chinese bonds were relative risk-free]). As a result, when domestic interest rates fall, investors tend to pull money OUT of the domestic economy and into foreign economies. This DEVALUES domestic currencies.

We know that when domestic currencies are devalued, this makes it more attractive for foreign economies to import domestic goods, and less attractive for local consumers to import foreign goods (for price-related reasons). Thus, net exports increases. This leads to an increase in aggregate expenditure, and subsequently, an rightward shift in the aggregate demand curve!

SO! There are 2 different pathways through which changes in the money supply can affect aggregate demand in an economy (and by association, Y, U, and P)

-----------------------

THE LONG RUN NEUTRALITY OF MONEY

Classical economists divided the economy into real and monetary sectors: they believed that changes in the money supply only affected the price level, but would not impact GDP in the long run

MV = PY where V and Y are constant (money has a constant velocity, and GDP tends to return to its potential leve in the long run)

Modern economist now understand that in the short run, changes in the money supply CAN impact GDP through the monetary transmission mechanism. At the same time, they state that in the long run, the "anchor and chain" mechanism will bring GDP back to its potential level (through wage adjustment)

Pretend this graph indicated that the increase in AD was due to an increase in the money supply. In the long run, inflationary pressures cause wages to increase, which effectively raises costs for firms. This shifts aggregate supply to the left until the real GDP is back at Y*, but at a higher price level

Hysteresis: some economists debate that Y* can be affected by short run trends in Y, not just factors and productivity (for an example, a long-lasting recessionary gap may cause worker skills to depreciate, thus bringing productivity down, and consequently lowering potential GDP as well)

---------------------------

SOME OTHER COOL THINGS

-Changes in the money supply cause larger changes in the interest rate when the money-demand curve is STEEP

-Changes in the interest rate cause larger changes in investment when the MEI curve is very FLAT

MONETARISTS: believe that the LPF is steep and the MEI is flat- they think that monetary changes can cause LARGE changes in GDP and price levels

KEYNESIANS: believe that the LPF is very flat and that the MEI is very steep- they think that monetary changes are much less effective than fiscal changes in affecting GDP and the price level

That's all for now. Only one more bit to cover for the midterm! =D

No comments:

Post a Comment