INFLATIONARY DEMAND SHOCKS AND INFLATION

-An increase in consumption, investment, government expenditures, and net exports causes an increase in aggregate expenditure, a rightward shift in aggregate demand, and an increase in the equilibrium price level.

IF THE GOVERNMENT DOES NOT VALIDATE INFLATION CAUSED BY AN ISOLATED DEMAND SHOCK

Aggregate demand will shift to the right as a result of this demand shock. Y is now greater than Y*, and thus we have an inflationary gap. however, wages adjust: excess demand for labour increases wages, which in turn increases firm costs. As a result, short run aggregate supply shifts to the left, and output returns to its original level, but at a higher price level. This is one-shot inflation. The price level is now at a higher equilibrium level, but since the demand shock is isolated, inflation will not be sustained.

IF THE GOVERNMENT DOES VALIDATE INFLATION CAUSED BY ISOLATED DEMAND SHOCKS

Aggregate demand will shift to the right as a result of this supply shock. In response to this, SRAS shifts to the left due to wage adjustment. However, if the government tries to validate this change in supply by increasing the money supply (which lowers interest rates, and ultimately shifts AD to the right), this puts NEW INFLATIONARY PRESSURES on an economy: basically, the natural chain and anchor mechanism is fighting against government policy here, and the result is sustained inflation within an inflationary gap. The SRAS want to return output to Y*, but the government continues to artificially increase AD through monetary policy. As both AD and SRAS continue to shift right and left, respectively, the price level will continuously climb. =(

------------------------------------------------------------------------------

WHAT ABOUT ACCELERATING INFLATION?

-We know that in most cases, demand shocks cause wage adjustment, and that if governments are not crafty, they may follow this up with monetary validation. If we look at this graphically, we can say that the inflation rate (the change in the price level divided by the original price level) could be graphically represented by the vertical distance between the original price point and the new price point.

-When AD and AS both shift up, the inflationary gap will persist.

-Graphically, we know that inflation is accelerating if the arrow between the price points gets longer and longer.

SO... two questions we need to answer are:

1) What creates persistent inflation (what causes inflation to hang around, instead of being a one-off)?

The answer: Validation

and

2) When is the inflation at a constant rate, and when is it at an accelerating rate (what causes inflation to get worse and worse)?

The answer: Expectations

ACCELERATION HYPOTHESIS

-If the economy is running an inflationary gap caused by either increased aggregate demand (for an example, demand resulting from China's increased demand for raw materials) or increased aggregate supply (for an example, increase supply due to lower world prices of raw materials)...

-AND if the central bank wants to maintain the "good time" (aka: it uses monetary policy to validate this inflationary gap, and tries to keep the gap from being closed)...

-THEN, inflation will persist, and be accelerating.

In summary, if the BoC maintains a constant inflationary gap, then the actual inflation rate will persist and accelerate (the economy will continue to inflate at progressively larger rates over time).

WHY?

1) EXPECTATION EFFECTS (remember, actual inflation is a combined result of gap inflation, expectation inflation, and supply shock inflation)

-An increase in aggregate demand causes an inflationary gap, and as we know, this ultimately causes prices to rise due to the wage change mechanism

-As a result, expectations are formed: workers demand that their wages rise at a similar rate over the next year to account for predicted inflation (for an example, let's say that they expect inflation to be 2%, then they will demand a 2% wage increase).

-If the BoC adds inflationary pressures by maintaining the gap, then this will create extra gap inflation of 2%, which stacks on top of the expectation inflation for a combined actual 4% rate of inflation.

-This overall 4% rate of inflation informs new expectations for the next year: workers will demand 4% wage increases, and those new expectation pressures stack onto persistent gap inflation for a total of 6% total inflation over the next year

-This continues on for quite a while, generating an inflationary spiral.

AS LONG AS THE BoC VALIDATES THE GAP, EXPECTATIONS ARE ALWAYS BEING REVISED UPWARDS (worker expect higher and higher inflation, and demand higher and higher wage increases). People come to expect this inflation, and build it into their wage demands.

2) MORE RAPID MONETARY VALIDATION IS REQUIRED

-If the BoC wants to maintain output above Y*, it has to increase the rate of growth in the money supply.

-This is because the inflation rate is accelerating, and therefore, to accommodate for increase transaction demands due to higher prices, the BoC must accelerate the growth of money (basically, it must print a larger and larger quantity of money each year)

-This validation becomes more and more dramatic as time goes on

Let's summarize what we know!

We have an isolated shock ---> There will be no gap in the long run

We have have a repeated AS shock ---> There will be a persistent gap

We have a repeated AD shock ---> There will be a persistent gap

At Y*, persistent inflation will consist of only expectation inflation

With a Gap, there will be accelerating inflation, due to the gap inflation on top of expectation inflation

Cost push inflation from Y* lead to a recessionary gap

Demand pull inflation from Y* leads to an inflationary gap

AGAIN: Is monetary validation a good idea?

Yes, because monetary validation can eliminate recessions more quickly than simply letting "nature take its course"

No, because it causes inflation

Additionally, as we now know, monetary validation can create expected inflation to increase over time, creating a wage-price spiral. Some economists argue that the disadvantages of these increased expectations could be avoided if the BoC never validated gaps in the first place!

Saturday, March 27, 2010

Inflation and Supply Shocks

FROM WAGE CHANGES TO PRICE CHANGES

-If a change in money wages is positive (wages increase), short run aggregate supply will decrease (it shifts to the left due to increased costs). This causes prices to rise, and the overall effect is inflationary

-If an change in money wages is negative (wages decrease), short run aggregate supply will increase (it shifts to the right due to lowered costs). This causes prices to fall, and the overall effect is deflationary.

Wages up --> Costs up ---> SRAS shifts left --> Equilibrium price level rises

Okay... so so far, we've talked about two causes of inflation: gap effects and worker expectations. There is, however, a third cause of inflationary pressures: AN EXOGENOUS SUPPLY SHOCK (for an example, a change in the price of raw materials, such as oil, can increase the general price level, which is why vegetables can start to cost more when the price of oil goes up).

SOOO

ACTUAL INFLATION IS A COMBINATION OF:

1: GAP INFLATION

2: EXPECTATION INFLATION

3: SUPPLY SHCOK INFLATION (even though that's a bit of an afterthought)

------------------------------------------

Next, we're going to talk about the difference between sustained/constant inflation and accelerating inflation.

CONSTANT/SUSTAINED INFLATION

-Here, we assume that there is no supply shock, and no output gaps

-As such, the ONLY cause for inflation when there is sustained inflation, is expectations

-This kind of inflation occurs when Y is equal to Y*

Let's summarize: constant inflation occurs when...

-There is no gap inflation

-There is no supply shock inflation

-Monetary growth is equal to the rate that wages increase at

-Actual inflation is equal to expected inflation

HOW IT WORKS:

1: Worker expectations trigger constant inflation (expectations cause workers to demand higher wages, which then causes SRAS to shift to the left)

2: The BoC validates the price increase by increase the money supply

SO.... let's say that we start off with expectation inflation at 2%. Workers anticipate future increases of 2% in the price level, so they demand higher wages, which causes SRAS to shift to the left as money wages rise. When the government validates this increase, they increase the money supply, which shifts SRAD to the right. Because of the way that this mechanism works, the price level will rise at the exact same rate as is predicted (because expectations are what catalyze the change). Actual inflation is equal to expected inflation, and output remains at Y*. THIS IS CONTINUOUS INFLATION AT A CONSTANT RATE.

NOTE* This isn't expansionary monetary policy- the BoC is not reducing the overnight target rate here- interest rates aren't affect by this. The BoC is merely accommodating for the growing demand for money by steadily increasing the nominal money supply. As such, the real money supply remains constant (so the ratio of money in the economy and the average price of products remains the same).

INFLATIONARY SUPPLY SHOCKS (negative supply shocks which temporarily inflate prices)

-Remember, in all cases of inflation, the price level rises to a new equilibrium level. In temporary inflationary situations, the price will simply remain at the new level, whereas in cases of persistent inflation, the equilibrium price level will continue to rise.

Inflationary supply shocks are caused by increased cost of productive inputs (for an example, an increase in the price of oil). This, in turn, causes costs to rise, which shifts SRAS to the left, and increases the price level while decreasing output.

BUT... as we know from previous chapters, this change is NOT permanent. Eventually, the higher unemployment which accompanies the supply-shock-recession puts downward pressures on wages, eventually causing them to fall. As a result of these wage-related cost savings to firms, the short run aggregate supply will shift back to its original level: costs will be the same as they once were, even though workers are being paid less. As SRAS shifts to the right, the price level and output level both shift back to what they were originally. SO, WE CAN CONCLUDE THAT INFLATIONARY SUPPLY SHOCKS ONLY CAUSE INFLATION IN THE SHORT RUN, AND THAT THERE IS NO SUSTAINED INFLATION HERE.

OKAY.. BUT WHAT HAPPENS WHEN WE HAVE AN ISOLATED SUPPLY SHOCK WHICH IS MONETARILY VALIDATED BY THE BoC?

Well, we start out at macroeconomic equilibrium, and then we shift SRAS to the left. This increases the price level and decreases the output level. After this, if the government tries to correct this recessionary gap by increasing the money supply (the money supply increases, which lowers interest rates, which increases investment and net exports, which drives aggregate expenditure up and shifts aggregate demand to the right), aggregate demand will shift to the right, which will bring output back to its equilibrium level, but at a higher general price level. As such, there will be more inflation than if the government does not intervene, but prices will still settle at the new equilibrium level, and inflation will not be persistant.

OKAY... BUT WHAT HAPPENS WHEN WE HAVE REPEATED SUPPLY SHOCKS WITHOUT MONETARY VALIDATION?

For an example, lets say we have cost push inflation, which occurs due to repeated increases in firms' costs. What happens then? Well, either the economy will stabilize at a higher price level and a smaller output level, OR persistent unemployment will erode the power of unions, causing monetary wages to fall, and bringing short run aggregate supply back to its original levels.

OKAY... BUT WHAT HAPPENS WHEN WE HAVE REPEATED SUPPLY SHOCKS WHICH ARE VALIDATED BY THE GOVERNMENT?

Well, then economies can enter into an inflationary spiral. For an example, if unions consistently negotiate to increase their monetary wages, and the government consistently validates this decrease in SRAS by printing more money, then an economy will experience consistent inflation (albeit, often the wage increases are very small, so inflation persists at a small but constant level). Basically, monetary validation reinforces price increases and offsets the natural tendency of Ye to return to Y* on its own, hence sustained inflation.

So.... is monetary validation of supply shocks desirable or undesirable? Yes and No!

No, because the BoC should allow for unemployment, which will eventually eliminate the output gap through the natural chain and anchor process.

Yes, because nations can avoid severe (albeit temporary) recessions by using monetary validation (although this comes at the cost of creating higher prices)

So its sort of a dilemma: governments must choose between long stretches of unemployment (no validating) or inflation (validating).

What is STAGFLATION? Stagflation is when supply shocks and monetary validating occur simultaneously, which leads to a NEGATIVE COMBINATION OF INFLATION AND UNEMPLOYMENT

Persistent Recessionary Gaps + Persistent Inflation: Continous SRAS shocks continue to push SRAS to the left, while continuous validation continues to push AD to the right. The overall effect on the output level is neutral, so the original recessionary gap is never closed. At the same time, both supply shocks and monetary validation continuously push up the price level, so the equilibrium price level will continuously rise while the economy remains in a recession. =(

-If a change in money wages is positive (wages increase), short run aggregate supply will decrease (it shifts to the left due to increased costs). This causes prices to rise, and the overall effect is inflationary

-If an change in money wages is negative (wages decrease), short run aggregate supply will increase (it shifts to the right due to lowered costs). This causes prices to fall, and the overall effect is deflationary.

Wages up --> Costs up ---> SRAS shifts left --> Equilibrium price level rises

Okay... so so far, we've talked about two causes of inflation: gap effects and worker expectations. There is, however, a third cause of inflationary pressures: AN EXOGENOUS SUPPLY SHOCK (for an example, a change in the price of raw materials, such as oil, can increase the general price level, which is why vegetables can start to cost more when the price of oil goes up).

SOOO

ACTUAL INFLATION IS A COMBINATION OF:

1: GAP INFLATION

2: EXPECTATION INFLATION

3: SUPPLY SHCOK INFLATION (even though that's a bit of an afterthought)

------------------------------------------

Next, we're going to talk about the difference between sustained/constant inflation and accelerating inflation.

CONSTANT/SUSTAINED INFLATION

-Here, we assume that there is no supply shock, and no output gaps

-As such, the ONLY cause for inflation when there is sustained inflation, is expectations

-This kind of inflation occurs when Y is equal to Y*

Let's summarize: constant inflation occurs when...

-There is no gap inflation

-There is no supply shock inflation

-Monetary growth is equal to the rate that wages increase at

-Actual inflation is equal to expected inflation

HOW IT WORKS:

1: Worker expectations trigger constant inflation (expectations cause workers to demand higher wages, which then causes SRAS to shift to the left)

2: The BoC validates the price increase by increase the money supply

SO.... let's say that we start off with expectation inflation at 2%. Workers anticipate future increases of 2% in the price level, so they demand higher wages, which causes SRAS to shift to the left as money wages rise. When the government validates this increase, they increase the money supply, which shifts SRAD to the right. Because of the way that this mechanism works, the price level will rise at the exact same rate as is predicted (because expectations are what catalyze the change). Actual inflation is equal to expected inflation, and output remains at Y*. THIS IS CONTINUOUS INFLATION AT A CONSTANT RATE.

NOTE* This isn't expansionary monetary policy- the BoC is not reducing the overnight target rate here- interest rates aren't affect by this. The BoC is merely accommodating for the growing demand for money by steadily increasing the nominal money supply. As such, the real money supply remains constant (so the ratio of money in the economy and the average price of products remains the same).

INFLATIONARY SUPPLY SHOCKS (negative supply shocks which temporarily inflate prices)

-Remember, in all cases of inflation, the price level rises to a new equilibrium level. In temporary inflationary situations, the price will simply remain at the new level, whereas in cases of persistent inflation, the equilibrium price level will continue to rise.

Inflationary supply shocks are caused by increased cost of productive inputs (for an example, an increase in the price of oil). This, in turn, causes costs to rise, which shifts SRAS to the left, and increases the price level while decreasing output.

BUT... as we know from previous chapters, this change is NOT permanent. Eventually, the higher unemployment which accompanies the supply-shock-recession puts downward pressures on wages, eventually causing them to fall. As a result of these wage-related cost savings to firms, the short run aggregate supply will shift back to its original level: costs will be the same as they once were, even though workers are being paid less. As SRAS shifts to the right, the price level and output level both shift back to what they were originally. SO, WE CAN CONCLUDE THAT INFLATIONARY SUPPLY SHOCKS ONLY CAUSE INFLATION IN THE SHORT RUN, AND THAT THERE IS NO SUSTAINED INFLATION HERE.

OKAY.. BUT WHAT HAPPENS WHEN WE HAVE AN ISOLATED SUPPLY SHOCK WHICH IS MONETARILY VALIDATED BY THE BoC?

Well, we start out at macroeconomic equilibrium, and then we shift SRAS to the left. This increases the price level and decreases the output level. After this, if the government tries to correct this recessionary gap by increasing the money supply (the money supply increases, which lowers interest rates, which increases investment and net exports, which drives aggregate expenditure up and shifts aggregate demand to the right), aggregate demand will shift to the right, which will bring output back to its equilibrium level, but at a higher general price level. As such, there will be more inflation than if the government does not intervene, but prices will still settle at the new equilibrium level, and inflation will not be persistant.

OKAY... BUT WHAT HAPPENS WHEN WE HAVE REPEATED SUPPLY SHOCKS WITHOUT MONETARY VALIDATION?

For an example, lets say we have cost push inflation, which occurs due to repeated increases in firms' costs. What happens then? Well, either the economy will stabilize at a higher price level and a smaller output level, OR persistent unemployment will erode the power of unions, causing monetary wages to fall, and bringing short run aggregate supply back to its original levels.

OKAY... BUT WHAT HAPPENS WHEN WE HAVE REPEATED SUPPLY SHOCKS WHICH ARE VALIDATED BY THE GOVERNMENT?

Well, then economies can enter into an inflationary spiral. For an example, if unions consistently negotiate to increase their monetary wages, and the government consistently validates this decrease in SRAS by printing more money, then an economy will experience consistent inflation (albeit, often the wage increases are very small, so inflation persists at a small but constant level). Basically, monetary validation reinforces price increases and offsets the natural tendency of Ye to return to Y* on its own, hence sustained inflation.

So.... is monetary validation of supply shocks desirable or undesirable? Yes and No!

No, because the BoC should allow for unemployment, which will eventually eliminate the output gap through the natural chain and anchor process.

Yes, because nations can avoid severe (albeit temporary) recessions by using monetary validation (although this comes at the cost of creating higher prices)

So its sort of a dilemma: governments must choose between long stretches of unemployment (no validating) or inflation (validating).

What is STAGFLATION? Stagflation is when supply shocks and monetary validating occur simultaneously, which leads to a NEGATIVE COMBINATION OF INFLATION AND UNEMPLOYMENT

Persistent Recessionary Gaps + Persistent Inflation: Continous SRAS shocks continue to push SRAS to the left, while continuous validation continues to push AD to the right. The overall effect on the output level is neutral, so the original recessionary gap is never closed. At the same time, both supply shocks and monetary validation continuously push up the price level, so the equilibrium price level will continuously rise while the economy remains in a recession. =(

The Gap Effect, and the Expectation Effect

THE WONDERFUL WORLD OF INFLATION:

People talk about inflation a LOT, so its probably a good idea know what it is. If you've survived macroeconomics without knowing what inflation is up until this point, congratulations, you live a seriously charmed life.

For the rest of us, lets reiterate:

Inflation is any rise in the general price level (P)

Inflation can be temporary/transitory (the price level increases to a new equilibrium price level, where it stays put for a while) or it can be sustained/persistant (the price level rises continuously over time)

In classical economics, aggregate demand shocks and aggregate supply shocks cause TEMPORARY inflation (one-time jumps in the price level) as a side effect of gap inflation. In this chapter, we are more concerned with exploring the causes of sustained inflation (which, as we will learn, is affected by people's expectations). We're also going to look at what causes accelerating inflation.

On a very basic level, prices can rise for two different reasons

1) There is a decrease in supply (this is called cost-push inflation)

2) There is an increase in demand (this is called demand-pull inflation)

HERE IS A LIST OF TERRIBLY IMPORTANT DEFINITIONS WHICH WE SHOULD ALL PROBABLY LEARN IF WE WANT TO DO WELL IN MACROECONOMICS:

Inflation - A rise in the consumer price index

Inflation Rate - The percentage change in the consumer price index

Zero Inflation - A situation where there is no percentage change in the consumer price index

Stable Inflation - A situation where the inflation rate remains relatively constant over time (ie: inflation is 2% for seven years in a row)

Accelerating Inflation - The inflation rate increases over time (ie: inflation is 2% in 1991, 4% in 1992, 8% in 1993, and 13% in 1994)

Disinflation - The inflation rate decrease over time (ie: inflation is 16% in 1991, 9% in 1992, 5% in 1993, and 3% in 1994)

Deflation - A negative rate of inflation: the consumer price index goes down (so goods end up costing less)

Low inflation: 1-3%

Medium inflation: 3-6%

High inflation: Over 6%

Hyperinflation: Over 20%

Why are we concerned with inflation? Because too much inflation inflicts a bunch of costs on society. Here are some of them:

-It decreases the purchasing power of people who are on fixed incomes (both contractually and in terms of pensionary incomes)

-It can arbitrarily redistribute income

-It undermines the efficiency of the price system by distorting relative prices (so its harder for consumers to tell if they are getting a good deal or if they are getting ripped off if the general price level is continuously in flux)

---------------------------------------

One last important concept is NAIRU, which is the non-accelerating inflationary rate of unemployment. Basically, this is the rate of unemployment present in an economy when there are no inflationary or recessionary gaps (when Y is at Y*). This does not mean that there is no unemployment- only that there is no GAP unemployment (there can still be frictional and structural unemployment). NAIRU is also sometimes called "full employment," or U*.

We're going to look at why NAIRU is called NAIRU in this chapter

--------------------------------------------------

INFLATION AND WAGE CHANGES:

Okay... why do people's wages change?

There are two factors which can explain why people's wages change

1) The gap effect

2) The expectation effect

THE GAP EFFECT

-Basically, this is demand-pull inflation caused by excess demand in the labour market.

-In an inflationary gap, we get GAP INFLATION. Y is larger than Y*, U is smaller than U*, and there is an excess demand for labour. As a result, firms are forced to raise wages in order to keep employees. The result of this rise in wages is that average costs rise (which, in turn, causes the short run aggregate supply to shift to the left, correcting the inflationary gap).

-In a recessionary gap, we get GAP DEFLATION. Y is smaller than Y*, U is greater than U*, and there is an excess supply of labour. As a result, firms can safely lower employee wages without the risk of losing employees (its better to have a low-paying job than no job at all). This, in turn, causes average costs to fall, which shifts short run aggregate supply to the right, correcting the inflationary gap.

-When there is no gap, there is NO INFLATION. Y equals Y*, U equal U*, demand and supply of labour are equal, wages remain constant, average costs remain constant, and the short run aggregate supply remains constant (as do prices).

The Phillips Curve shows the inverse relation between the unemployment rate and the rate of changes in nominal wages.

Basically, as unemployment gets higher, wage increases get smaller and smaller, and eventually, turn into wage decreases (salary cuts).

Classical economists ONLY considered the gap effect to be a source of inflation, and believed that gaps would only create a temporary period of inflation. They also believed that if there was no gap, that there would be no increase in wages...

They were entirely correct... there is also...

THE EXPECTATION EFFECT

-Here, expected inflation is taken into account when employees are negotiating wage demands with their employers

-Here, inflation is like a "self fulfilling prophecy". If employees believe that there will be inflation of a certain level over the next year, they will negotiate for higher wages to account for that inflation. This, in turn, increases firms' average costs, which shifts the SRAD curve to the left, effecting CAUSING an increase in prices in-step with what employees predicted. In other words, preemptively adjusting wages for expected inflation can MANUFACTURE real inflation!

Causes of expectation inflation:

-Expectation inflation can be caused by backward-looking, where people assume that past rates in inflation will continue into the future (people believe that history repeats itself)

-At the same time, if an economy has an extremely volatile inflation rate, it may take time for people to develop a psychological trend to respond to inflation- it takes a while to figure out how the pattern works and predict accurately for the future.

-Expectation inflation can also be forward-looking. Workers could look at governments' macroeconomic policies to predict what future changes may be in store (they can prognosticate).

-The main thing to remember is that in economics, we assume that people are RATIONAL BEINGS with their own best interests at heart. People try to use all available information to the best of their ability, and for the most part, they are correct. People can adjust rapidly to changes.

The TOTAL EFFECT: Changes in money wages are a combination of the gap effect and the expectation effect

-In this way, we can decompose an increase in the rate of wage changes into the gap effect (excess demand for labour) and the expectation effect (psychology)

-We can think of the expectation effect as the "cake" and the gap effect as the "icing", which causes increased wages changes on top of expected changes

-The total effect can be either positive or negative.

People talk about inflation a LOT, so its probably a good idea know what it is. If you've survived macroeconomics without knowing what inflation is up until this point, congratulations, you live a seriously charmed life.

For the rest of us, lets reiterate:

Inflation is any rise in the general price level (P)

Inflation can be temporary/transitory (the price level increases to a new equilibrium price level, where it stays put for a while) or it can be sustained/persistant (the price level rises continuously over time)

In classical economics, aggregate demand shocks and aggregate supply shocks cause TEMPORARY inflation (one-time jumps in the price level) as a side effect of gap inflation. In this chapter, we are more concerned with exploring the causes of sustained inflation (which, as we will learn, is affected by people's expectations). We're also going to look at what causes accelerating inflation.

On a very basic level, prices can rise for two different reasons

1) There is a decrease in supply (this is called cost-push inflation)

2) There is an increase in demand (this is called demand-pull inflation)

HERE IS A LIST OF TERRIBLY IMPORTANT DEFINITIONS WHICH WE SHOULD ALL PROBABLY LEARN IF WE WANT TO DO WELL IN MACROECONOMICS:

Inflation - A rise in the consumer price index

Inflation Rate - The percentage change in the consumer price index

Zero Inflation - A situation where there is no percentage change in the consumer price index

Stable Inflation - A situation where the inflation rate remains relatively constant over time (ie: inflation is 2% for seven years in a row)

Accelerating Inflation - The inflation rate increases over time (ie: inflation is 2% in 1991, 4% in 1992, 8% in 1993, and 13% in 1994)

Disinflation - The inflation rate decrease over time (ie: inflation is 16% in 1991, 9% in 1992, 5% in 1993, and 3% in 1994)

Deflation - A negative rate of inflation: the consumer price index goes down (so goods end up costing less)

Low inflation: 1-3%

Medium inflation: 3-6%

High inflation: Over 6%

Hyperinflation: Over 20%

Why are we concerned with inflation? Because too much inflation inflicts a bunch of costs on society. Here are some of them:

-It decreases the purchasing power of people who are on fixed incomes (both contractually and in terms of pensionary incomes)

-It can arbitrarily redistribute income

-It undermines the efficiency of the price system by distorting relative prices (so its harder for consumers to tell if they are getting a good deal or if they are getting ripped off if the general price level is continuously in flux)

---------------------------------------

One last important concept is NAIRU, which is the non-accelerating inflationary rate of unemployment. Basically, this is the rate of unemployment present in an economy when there are no inflationary or recessionary gaps (when Y is at Y*). This does not mean that there is no unemployment- only that there is no GAP unemployment (there can still be frictional and structural unemployment). NAIRU is also sometimes called "full employment," or U*.

We're going to look at why NAIRU is called NAIRU in this chapter

--------------------------------------------------

INFLATION AND WAGE CHANGES:

Okay... why do people's wages change?

There are two factors which can explain why people's wages change

1) The gap effect

2) The expectation effect

THE GAP EFFECT

-Basically, this is demand-pull inflation caused by excess demand in the labour market.

-In an inflationary gap, we get GAP INFLATION. Y is larger than Y*, U is smaller than U*, and there is an excess demand for labour. As a result, firms are forced to raise wages in order to keep employees. The result of this rise in wages is that average costs rise (which, in turn, causes the short run aggregate supply to shift to the left, correcting the inflationary gap).

-In a recessionary gap, we get GAP DEFLATION. Y is smaller than Y*, U is greater than U*, and there is an excess supply of labour. As a result, firms can safely lower employee wages without the risk of losing employees (its better to have a low-paying job than no job at all). This, in turn, causes average costs to fall, which shifts short run aggregate supply to the right, correcting the inflationary gap.

-When there is no gap, there is NO INFLATION. Y equals Y*, U equal U*, demand and supply of labour are equal, wages remain constant, average costs remain constant, and the short run aggregate supply remains constant (as do prices).

The Phillips Curve shows the inverse relation between the unemployment rate and the rate of changes in nominal wages.

Basically, as unemployment gets higher, wage increases get smaller and smaller, and eventually, turn into wage decreases (salary cuts).

Classical economists ONLY considered the gap effect to be a source of inflation, and believed that gaps would only create a temporary period of inflation. They also believed that if there was no gap, that there would be no increase in wages...

They were entirely correct... there is also...

THE EXPECTATION EFFECT

-Here, expected inflation is taken into account when employees are negotiating wage demands with their employers

-Here, inflation is like a "self fulfilling prophecy". If employees believe that there will be inflation of a certain level over the next year, they will negotiate for higher wages to account for that inflation. This, in turn, increases firms' average costs, which shifts the SRAD curve to the left, effecting CAUSING an increase in prices in-step with what employees predicted. In other words, preemptively adjusting wages for expected inflation can MANUFACTURE real inflation!

Causes of expectation inflation:

-Expectation inflation can be caused by backward-looking, where people assume that past rates in inflation will continue into the future (people believe that history repeats itself)

-At the same time, if an economy has an extremely volatile inflation rate, it may take time for people to develop a psychological trend to respond to inflation- it takes a while to figure out how the pattern works and predict accurately for the future.

-Expectation inflation can also be forward-looking. Workers could look at governments' macroeconomic policies to predict what future changes may be in store (they can prognosticate).

-The main thing to remember is that in economics, we assume that people are RATIONAL BEINGS with their own best interests at heart. People try to use all available information to the best of their ability, and for the most part, they are correct. People can adjust rapidly to changes.

The TOTAL EFFECT: Changes in money wages are a combination of the gap effect and the expectation effect

-In this way, we can decompose an increase in the rate of wage changes into the gap effect (excess demand for labour) and the expectation effect (psychology)

-We can think of the expectation effect as the "cake" and the gap effect as the "icing", which causes increased wages changes on top of expected changes

-The total effect can be either positive or negative.

Wednesday, March 17, 2010

Monetary Policy in Canada

This is the last piece of the puzzle! This chapter is all about how the government of Canada uses policy instruments to change the money supply!

The central bank can set the money supply and let the market determine the interest rate

OR

The central bank can set the interest rate and the money supply will adjust to this interest rate

PROBLEMS WITH ADJUSTING THE MONEY SUPPLY DIRECTLY:

-The Bank of Canada (BoC) cannot directly control the money supply through the currency ratio and the reserve ratio (they can't control minds and make banks hold more or less assets and make people hold more or less money)

-Also, it's sometimes confusing as to which definition of the money supply should be used: H? M1? M2? Know know...

SO, the BoC sets the interest rate instead, and then accommodates for fluctuations and changes by using open market operations. (The US directly changes the money supply by printing more or less money, while Canada simply changes the bank rate)

There are 5 Different Policy Instruments The BoC Uses:

1: The Overnight Target Rate (Which is changes by changing the Bank Rate)

2: Buyback Operations (Specials and Reverses)

3: Shifting Government of Canada Accounts

4: Moral Suasion

5: The Announcement Effect

NOTE** It's important to know the difference between operational targets: usually, governments can only target one factor, so they have to choose between targeting

a) The Exchange Rate (from 1962-1970, Canada targeted the exchange rate and tried to keep its external value at 92.5)

b) The Interest Rate/Money Supply (from 1975-1982, the BoC would adjust interest rates to affect the money supply through the liquidity preference system. The problem was that interest rates became extremely volatile, and the government had no way of controlling the price level)

c) The Inflation Rate (the BoC uses interest rates and money supply as a policy instrument to affect the inflation rate, so the operational target is currently PRICES. The BoC tries to keep inflation at about 2%, because a little bit of inflation is healthy

Policy Variables: These are the ultimate targets for policy changes

Y - stable economic growth

U - low unemployment

P - Low Inflation !!! THIS IS THE PRESENT GOAL OF THE BoC

----------------------------------

THE 5 POLICY INSTRUMENTS

1: THE OVERNIGHT RATE

Note* the interest rates on borrowing increase as the term of the loan grows longer (as a compensation for leaving money inaccessible for a longer amount of time)

The Overnight Rate: This is the daily interest rate which chartered banks charge each other for borrowing money (or that investment dealers charge to banks for borrowing money) in cases where they have insufficient funds to clear cheques. These loans have a very short maturity (the term is extremely short) and the interest rates are MARKET DRIVEN

The BoC is the LENDER OF LAST RESORT

The Bank Rate is the rate which the BoC charges to lend to money to chartered banks. This is the upper limit of the overnight rate. Because the bank rate is so high, most chartered banks will not borrow from the bank of Canada unless all other sources refuse to loan them money

The Overnight Rate Operational Band: This is the difference between the highest overnight rate (the bank rate) and the lowest overnight rate (the rate the BoC pays to borrow for depoits)

-It is measured in basis points (each basis point is worth 0.01%, so an operational band of 50 basis points would mean a difference of 0.5% between the highest and lowest overnight rates)

Overnight Rate Target: the midpoint of the operational band for overnight rates, as set by the BoC

-THIS is the policy instrument used by the BoC to affect the interest rate

-There are fixed announcement dates: the BoC announces the overnight rate target 8 times per year

The USA uses a slightly different system...

OKAY: so basically, the bank rate is FIXED by the BoC

-Money's liquidity (the demand for money) is given

-The BoC accommodates the money supply to ensure equilibrium in the money market

-The money supply is thus endogenous, and becomes determined from the interest rates and the demand for money!

1: BoC increases the overnight rate (i goes up)

2: Banks increase their target reserves to buffer against this higher opportunity cost of borrowing from the BoC

3: The money supply decreases (because the reserve ratio is higher)

4: The market interest rate goes up!

This is a long-about way of showing how the market interest rate (which includes the prime rate, the 5-year mortgage rate, and commercial lines of credit) is related to the overnight interest rate!

NOTE* A change in the overnight rate target and other market interest rates usually happens very quickly BUT the demand for loans changes gradually (so the first step of the overall transmission mechanism is much faster than then subsequent steps)

As the demand for money changes, the BoC accommodates by using open market operations!

2: BUYBACK OPERATIONS (INCLUDING OPEN MARKET OPERATIONS)

-The BoC Uses Specials and Reverses to stabilize the overnight rate inside the operational band

-Buyback operations are used to fine-tune the overnight rate target within one basis point of the target

SPECIALS (Specials purchase and resale agreement):

-This is a transaction in which the BoC offers to purchase government of Canada securities from major financial players with an agreement to sell them back at a predetermined price the next business day

-This allows the BoC to put money into the system for one day

-This OFFSETS UPWARD PRESSURES on the overnight rate (by adding a bit to the money supply, the BoC decreases the interest rate a little bit)

-The BoC initiates SPRAs daily if overnight funds are generally trading above the target rate

-Differences between the purchase and the sale price determines the overnight rate

REVERSES (Sale and repurchase agreement)

-This is a transaction in which the BoC offers to SELL government securities to major financial parties with an agreement to buy them back at predetermined prices the next business day (this sale is called a reverse)

-Basically, this let's the BoC take cash out of the system for a day (by coaxing investors to temporarily store wealth in bonds instead of money)

-Reverses are used to offset downward pressures on the overnight rate

-The BoC initiates reverses daily if overnight funds are generally trading below the target rate

OPEN MARKET OPERATIONS (OMO): LONG RUN MONETARY ACCOMMODATION

-An OMO is the purchase/sale of government securities by the BoC in the open market for long run monetary accommodation

-Government securities are long run loans to the government

-Treasury bills are short term loans to the government

-These are auctioned off every Thursday, just like stocks, in a market

The BoC BUYS securities to increase excess reserves and attempt to increase the money supply

The BoC SELLS securities to decrease excess reserves and attempt to decrease the money supply

This analysis assumes that there are no cash drains, and that the reserve ratio remains constant in the long run (neither of which may be true)

3: SHIFTING GOVERNMENT OF CANADA DEPOSITS

Cash Management: The Bank of Canada shifts Government of Canada deposits to and from the Bank of Canada and the chartered banks. This is the major day-to-day instrument which the BoC uses to reinforce overnight rate targets within the operational band

Transferring money to a chartered bank increases their reserves, which allows the chartered bank to safely lend out more money, thus increasing the money supply

Transferring money from a chartered bank back to the BoC decreases chartered banks' reserves, which forces the chartered bank to lend out a smaller proportion of money, thus decreasing the money supply

4: MORAL SUASION

-The BoC enlists the cooperation of commercial banks

-This is possible because there is such a small number of banks in Canada

-Since there are not required reserves in Canada (required reserves are not legislated), this tool is more important

-For an example, the BoC may require an increase in settlement balances held at the BoC

5: THE ANNOUNCEMENT EFFECT

-There are fixed announcement dates where the BoC announces the bank rate (8 times per year)

-Like moral suasion, an increase in the bank rate sends a signal to the economy of the government's intentions, which can affect private investment (due to changed expectations)

CONCLUSION: The BoC fixes the overnight rate target, then uses buyback operations and shifting to reinforce it and open market operation to accommodate the demand for money in the long run

1: Policy instruments: The BoC sets the bank rate

2: The Money Market which defines reserves determines the money supply and the equilibrium interest rate

3: Transmission to real sector through the investment and net export effects

GAPBUSTING GUIDE

TO FIX A RECESSIONARY GAP (CREATE EASY MONEY)

-Decrease the target rate

-Increase the money supply

-Decrease interest rates

-Increase Investment and net exports

-Increase Aggregate Demand

-Y moves to the right, back to Y*

TO FIX AN INFLATIONARY GAP (TIGHTEN MONEY)

-Increase the target rate

-Decrease the money supply

-Increase interest

-Decrease investment and net exports

-Decrease aggregate demand

-Y moves left to Y*

The central bank can set the money supply and let the market determine the interest rate

OR

The central bank can set the interest rate and the money supply will adjust to this interest rate

PROBLEMS WITH ADJUSTING THE MONEY SUPPLY DIRECTLY:

-The Bank of Canada (BoC) cannot directly control the money supply through the currency ratio and the reserve ratio (they can't control minds and make banks hold more or less assets and make people hold more or less money)

-Also, it's sometimes confusing as to which definition of the money supply should be used: H? M1? M2? Know know...

SO, the BoC sets the interest rate instead, and then accommodates for fluctuations and changes by using open market operations. (The US directly changes the money supply by printing more or less money, while Canada simply changes the bank rate)

There are 5 Different Policy Instruments The BoC Uses:

1: The Overnight Target Rate (Which is changes by changing the Bank Rate)

2: Buyback Operations (Specials and Reverses)

3: Shifting Government of Canada Accounts

4: Moral Suasion

5: The Announcement Effect

NOTE** It's important to know the difference between operational targets: usually, governments can only target one factor, so they have to choose between targeting

a) The Exchange Rate (from 1962-1970, Canada targeted the exchange rate and tried to keep its external value at 92.5)

b) The Interest Rate/Money Supply (from 1975-1982, the BoC would adjust interest rates to affect the money supply through the liquidity preference system. The problem was that interest rates became extremely volatile, and the government had no way of controlling the price level)

c) The Inflation Rate (the BoC uses interest rates and money supply as a policy instrument to affect the inflation rate, so the operational target is currently PRICES. The BoC tries to keep inflation at about 2%, because a little bit of inflation is healthy

Policy Variables: These are the ultimate targets for policy changes

Y - stable economic growth

U - low unemployment

P - Low Inflation !!! THIS IS THE PRESENT GOAL OF THE BoC

----------------------------------

THE 5 POLICY INSTRUMENTS

1: THE OVERNIGHT RATE

Note* the interest rates on borrowing increase as the term of the loan grows longer (as a compensation for leaving money inaccessible for a longer amount of time)

The Overnight Rate: This is the daily interest rate which chartered banks charge each other for borrowing money (or that investment dealers charge to banks for borrowing money) in cases where they have insufficient funds to clear cheques. These loans have a very short maturity (the term is extremely short) and the interest rates are MARKET DRIVEN

The BoC is the LENDER OF LAST RESORT

The Bank Rate is the rate which the BoC charges to lend to money to chartered banks. This is the upper limit of the overnight rate. Because the bank rate is so high, most chartered banks will not borrow from the bank of Canada unless all other sources refuse to loan them money

The Overnight Rate Operational Band: This is the difference between the highest overnight rate (the bank rate) and the lowest overnight rate (the rate the BoC pays to borrow for depoits)

-It is measured in basis points (each basis point is worth 0.01%, so an operational band of 50 basis points would mean a difference of 0.5% between the highest and lowest overnight rates)

Overnight Rate Target: the midpoint of the operational band for overnight rates, as set by the BoC

-THIS is the policy instrument used by the BoC to affect the interest rate

-There are fixed announcement dates: the BoC announces the overnight rate target 8 times per year

The USA uses a slightly different system...

OKAY: so basically, the bank rate is FIXED by the BoC

-Money's liquidity (the demand for money) is given

-The BoC accommodates the money supply to ensure equilibrium in the money market

-The money supply is thus endogenous, and becomes determined from the interest rates and the demand for money!

1: BoC increases the overnight rate (i goes up)

2: Banks increase their target reserves to buffer against this higher opportunity cost of borrowing from the BoC

3: The money supply decreases (because the reserve ratio is higher)

4: The market interest rate goes up!

This is a long-about way of showing how the market interest rate (which includes the prime rate, the 5-year mortgage rate, and commercial lines of credit) is related to the overnight interest rate!

NOTE* A change in the overnight rate target and other market interest rates usually happens very quickly BUT the demand for loans changes gradually (so the first step of the overall transmission mechanism is much faster than then subsequent steps)

As the demand for money changes, the BoC accommodates by using open market operations!

2: BUYBACK OPERATIONS (INCLUDING OPEN MARKET OPERATIONS)

-The BoC Uses Specials and Reverses to stabilize the overnight rate inside the operational band

-Buyback operations are used to fine-tune the overnight rate target within one basis point of the target

SPECIALS (Specials purchase and resale agreement):

-This is a transaction in which the BoC offers to purchase government of Canada securities from major financial players with an agreement to sell them back at a predetermined price the next business day

-This allows the BoC to put money into the system for one day

-This OFFSETS UPWARD PRESSURES on the overnight rate (by adding a bit to the money supply, the BoC decreases the interest rate a little bit)

-The BoC initiates SPRAs daily if overnight funds are generally trading above the target rate

-Differences between the purchase and the sale price determines the overnight rate

REVERSES (Sale and repurchase agreement)

-This is a transaction in which the BoC offers to SELL government securities to major financial parties with an agreement to buy them back at predetermined prices the next business day (this sale is called a reverse)

-Basically, this let's the BoC take cash out of the system for a day (by coaxing investors to temporarily store wealth in bonds instead of money)

-Reverses are used to offset downward pressures on the overnight rate

-The BoC initiates reverses daily if overnight funds are generally trading below the target rate

OPEN MARKET OPERATIONS (OMO): LONG RUN MONETARY ACCOMMODATION

-An OMO is the purchase/sale of government securities by the BoC in the open market for long run monetary accommodation

-Government securities are long run loans to the government

-Treasury bills are short term loans to the government

-These are auctioned off every Thursday, just like stocks, in a market

The BoC BUYS securities to increase excess reserves and attempt to increase the money supply

The BoC SELLS securities to decrease excess reserves and attempt to decrease the money supply

This analysis assumes that there are no cash drains, and that the reserve ratio remains constant in the long run (neither of which may be true)

3: SHIFTING GOVERNMENT OF CANADA DEPOSITS

Cash Management: The Bank of Canada shifts Government of Canada deposits to and from the Bank of Canada and the chartered banks. This is the major day-to-day instrument which the BoC uses to reinforce overnight rate targets within the operational band

Transferring money to a chartered bank increases their reserves, which allows the chartered bank to safely lend out more money, thus increasing the money supply

Transferring money from a chartered bank back to the BoC decreases chartered banks' reserves, which forces the chartered bank to lend out a smaller proportion of money, thus decreasing the money supply

4: MORAL SUASION

-The BoC enlists the cooperation of commercial banks

-This is possible because there is such a small number of banks in Canada

-Since there are not required reserves in Canada (required reserves are not legislated), this tool is more important

-For an example, the BoC may require an increase in settlement balances held at the BoC

5: THE ANNOUNCEMENT EFFECT

-There are fixed announcement dates where the BoC announces the bank rate (8 times per year)

-Like moral suasion, an increase in the bank rate sends a signal to the economy of the government's intentions, which can affect private investment (due to changed expectations)

CONCLUSION: The BoC fixes the overnight rate target, then uses buyback operations and shifting to reinforce it and open market operation to accommodate the demand for money in the long run

1: Policy instruments: The BoC sets the bank rate

2: The Money Market which defines reserves determines the money supply and the equilibrium interest rate

3: Transmission to real sector through the investment and net export effects

GAPBUSTING GUIDE

TO FIX A RECESSIONARY GAP (CREATE EASY MONEY)

-Decrease the target rate

-Increase the money supply

-Decrease interest rates

-Increase Investment and net exports

-Increase Aggregate Demand

-Y moves to the right, back to Y*

TO FIX AN INFLATIONARY GAP (TIGHTEN MONEY)

-Increase the target rate

-Decrease the money supply

-Increase interest

-Decrease investment and net exports

-Decrease aggregate demand

-Y moves left to Y*

The Transmission Mechanism

So... what happens when the money supply changes? How does this affect things? That's what we're going to figure out today!

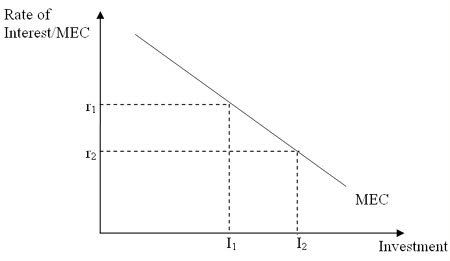

Remember the marginal efficiency of investment function?

There are two reasons why interest rates and desire for investment are negatively related

-lower interest rates mean that there is a lower opportunity cost for investing (it costs less to borrow money)

-when interest rates are lower, investing in capital becomes more attractive than keeping money in bonds (so if buying a new mixmaster will have a 4% yield, my friend the baker is much more likely to buy one when an equivalently-priced bond would only give him a 2% yield)

-Investment is determined by the REAL interest rate: for simplicity's sake, just assume that there is no inflation in this model for now

SO: There is an investment transmission mechanism

Let's do this in steps

1: The government changes the money supply (we'll learn how in the next little while)

2: The change in the money supply, thanks to the way the money market works, causes interest rates to fall (this is liquidity preference theory)

3: Lower interest rates cause investment to increase (this is marginal efficiency of investment theory)

4: Increased investment causes the family of aggregate expenditure curves for this economy to shift up

5: A shift up in aggregate expenditure causes aggregate demand to shift to the right, indicating an increasing in GDP, a decrease in unemployment, and an increase in the price level

BE SURE THAT YOU CAN REPRESENT EACH OF THESE STEPS GRAPHICALLY! If you have any questions about that, just send me an email and I will spell it out for you! =D

------------------------------

THERE IS ALSO AN EXCHANGE RATE TRANSMISSION EFFECT:

In open economies, consumers are not restricted to buying domestic bonds- they can also buy bonds sold by foreign governments. Thus, when the interest rate falls for one country in comparison with other countries, this makes that particular country's bonds less attractive for investors (if China's interest rate is 25% and Canada's is 4%, why the hell would you put your money in Canadian bonds [assuming the Chinese bonds were relative risk-free]). As a result, when domestic interest rates fall, investors tend to pull money OUT of the domestic economy and into foreign economies. This DEVALUES domestic currencies.

We know that when domestic currencies are devalued, this makes it more attractive for foreign economies to import domestic goods, and less attractive for local consumers to import foreign goods (for price-related reasons). Thus, net exports increases. This leads to an increase in aggregate expenditure, and subsequently, an rightward shift in the aggregate demand curve!

SO! There are 2 different pathways through which changes in the money supply can affect aggregate demand in an economy (and by association, Y, U, and P)

-----------------------

THE LONG RUN NEUTRALITY OF MONEY

Classical economists divided the economy into real and monetary sectors: they believed that changes in the money supply only affected the price level, but would not impact GDP in the long run

MV = PY where V and Y are constant (money has a constant velocity, and GDP tends to return to its potential leve in the long run)

Modern economist now understand that in the short run, changes in the money supply CAN impact GDP through the monetary transmission mechanism. At the same time, they state that in the long run, the "anchor and chain" mechanism will bring GDP back to its potential level (through wage adjustment)

Pretend this graph indicated that the increase in AD was due to an increase in the money supply. In the long run, inflationary pressures cause wages to increase, which effectively raises costs for firms. This shifts aggregate supply to the left until the real GDP is back at Y*, but at a higher price level

Hysteresis: some economists debate that Y* can be affected by short run trends in Y, not just factors and productivity (for an example, a long-lasting recessionary gap may cause worker skills to depreciate, thus bringing productivity down, and consequently lowering potential GDP as well)

---------------------------

SOME OTHER COOL THINGS

-Changes in the money supply cause larger changes in the interest rate when the money-demand curve is STEEP

-Changes in the interest rate cause larger changes in investment when the MEI curve is very FLAT

MONETARISTS: believe that the LPF is steep and the MEI is flat- they think that monetary changes can cause LARGE changes in GDP and price levels

KEYNESIANS: believe that the LPF is very flat and that the MEI is very steep- they think that monetary changes are much less effective than fiscal changes in affecting GDP and the price level

That's all for now. Only one more bit to cover for the midterm! =D

The Demand & Supply for Money

The Liquidity Preference Function: This shows people's preference to hold money (cash balances) rather than bonds (interest bearing assets)

-People have a choice between holding their wealth in one of two ways: bonds or money

-Money pays no returns, and bonds do pay a return

-The opportunity cost of holding money is the interest rate one earns on a bond

-People only want to hold money when it provides benefits which at least equal the cost of forgoing bond interest

3 REASONS WHY PEOPLE HOLD MONEY

1: TRANSACTION DEMANDS FOR MONEY

-People hold money so that they can make transactions

2: PRECAUTIONARY DEMAND FOR MONEY:

-People hold money in case they experience an emergency where money would is required

-There is uncertainty sometimes about the timing of receipts and payments, so it can be strategic to have a buffer of cash savings to "tide yourself over"

3: SPECULATIVE DEMAND FOR MONEY:

-People hold money because they believe it will be more strategic to buy bonds in the near future than in the immediate present (if the interest rate is really low, for interest, waiting for the interest raise to rise before buying bonds will be more financially strategic)

The transaction and precautionary demands for money account for the distance between the money demand curve and the Y-axis. When the demand for money shifts to the left or right, this is usually due to a change in transaction demands (for an example, if GDP increases or prices increase, consumers will have higher transaction demands)

The speculative demand for money explains why the liquidity preference curve is downward sloping: the opportunity cost of holding money increases as interest rates increase, so the higher the interest rates, the lower the demand for money (this is dependent on nominal interest rates, rather than real interest rates, as this is a PSYCHOLOGICAL, rather than an accounting effect)

Income, Prices, and The Nominal Interest Rate Affect Demand for Money!

The higher income is, the more transactions there are within an economy, so the higher demand for money will be

+ Positive Relation

The higher the nominal interest rate, the lower the demand for money will be, for reasons related to opportunity cost

- Negative Relation

The higher the price level is, the higher demand for money will be (this is called inflationary demand for money), because a greater monetary value of transaction will be required to facilitate the same amount of real spending: households need more money to carry out their transactions.

+ Positive Relation

Note* when interest rates are very very very high, the only demand for money is transaction demands (so this is the space between the liquidity preference function's asymptote and the Y axis)

THE SUPPLY OF MONEY

-The money multiplier is relatively constant

-The currency ration and and reserve ratio only change during times of uncertainty (usually, they both increase when the future is murky)

-The money supply is independent from the interest rate (although it affects the interest rate)

-In our model, we say that the money supply is a constant, and that it is perfectly inelastic: it is represented by a straight line on our graph

-The real money supply is M/P: this describes money's purchasing power in terms of goods and services

PUTTING SUPPLY AND DEMAND TOGETHER: MONETARY EQUILIBRIUM

(This is also called liquidity preference theory of interest, or the portfolio balance theory)

-This is a short run analysis of how interest rates are affected by the money supply- it is very different than the long run analysis we talked about earlier

Okay: So..

-The supply of money is perfectly inelastic (a vertical line)

-The demand for money varies inversely with the interest rate (it is a downward sloping curve)

Equilibrium occurs when demand and supply for money intersect: M = L

Notice that because the demand for money is downward sloping, the money supply affects equilibrium interest rates: a higher money supply renders lower interest rates, while a lower money supply renders higher interest rates

Monetary equilibrium is a stable equilibrium: if there is higher demand for money than money supplied, then a large number of people will begin to sell-off their bonds to generate some extra money. Because of an excess influx of bonds being sold on the market, the price of bonds will fall, while their relative yields will increase. This, in turn, causes the interest rate to rise, and it will rise until the money market is in equilibrium. A similar mechanism returns interest rates to an equilibrium level when there is an excess supply of money.

That's all for now!

-People have a choice between holding their wealth in one of two ways: bonds or money

-Money pays no returns, and bonds do pay a return

-The opportunity cost of holding money is the interest rate one earns on a bond

-People only want to hold money when it provides benefits which at least equal the cost of forgoing bond interest

3 REASONS WHY PEOPLE HOLD MONEY

1: TRANSACTION DEMANDS FOR MONEY

-People hold money so that they can make transactions

2: PRECAUTIONARY DEMAND FOR MONEY:

-People hold money in case they experience an emergency where money would is required

-There is uncertainty sometimes about the timing of receipts and payments, so it can be strategic to have a buffer of cash savings to "tide yourself over"

3: SPECULATIVE DEMAND FOR MONEY:

-People hold money because they believe it will be more strategic to buy bonds in the near future than in the immediate present (if the interest rate is really low, for interest, waiting for the interest raise to rise before buying bonds will be more financially strategic)

The transaction and precautionary demands for money account for the distance between the money demand curve and the Y-axis. When the demand for money shifts to the left or right, this is usually due to a change in transaction demands (for an example, if GDP increases or prices increase, consumers will have higher transaction demands)

The speculative demand for money explains why the liquidity preference curve is downward sloping: the opportunity cost of holding money increases as interest rates increase, so the higher the interest rates, the lower the demand for money (this is dependent on nominal interest rates, rather than real interest rates, as this is a PSYCHOLOGICAL, rather than an accounting effect)

Income, Prices, and The Nominal Interest Rate Affect Demand for Money!

The higher income is, the more transactions there are within an economy, so the higher demand for money will be

+ Positive Relation

The higher the nominal interest rate, the lower the demand for money will be, for reasons related to opportunity cost

- Negative Relation

The higher the price level is, the higher demand for money will be (this is called inflationary demand for money), because a greater monetary value of transaction will be required to facilitate the same amount of real spending: households need more money to carry out their transactions.

+ Positive Relation

Note* when interest rates are very very very high, the only demand for money is transaction demands (so this is the space between the liquidity preference function's asymptote and the Y axis)

THE SUPPLY OF MONEY

-The money multiplier is relatively constant

-The currency ration and and reserve ratio only change during times of uncertainty (usually, they both increase when the future is murky)

-The money supply is independent from the interest rate (although it affects the interest rate)

-In our model, we say that the money supply is a constant, and that it is perfectly inelastic: it is represented by a straight line on our graph

-The real money supply is M/P: this describes money's purchasing power in terms of goods and services

PUTTING SUPPLY AND DEMAND TOGETHER: MONETARY EQUILIBRIUM

(This is also called liquidity preference theory of interest, or the portfolio balance theory)

-This is a short run analysis of how interest rates are affected by the money supply- it is very different than the long run analysis we talked about earlier

Okay: So..

-The supply of money is perfectly inelastic (a vertical line)

-The demand for money varies inversely with the interest rate (it is a downward sloping curve)

Equilibrium occurs when demand and supply for money intersect: M = L

Notice that because the demand for money is downward sloping, the money supply affects equilibrium interest rates: a higher money supply renders lower interest rates, while a lower money supply renders higher interest rates

Monetary equilibrium is a stable equilibrium: if there is higher demand for money than money supplied, then a large number of people will begin to sell-off their bonds to generate some extra money. Because of an excess influx of bonds being sold on the market, the price of bonds will fall, while their relative yields will increase. This, in turn, causes the interest rate to rise, and it will rise until the money market is in equilibrium. A similar mechanism returns interest rates to an equilibrium level when there is an excess supply of money.

That's all for now!

Saturday, March 6, 2010

Bonds!

TODAY: WE ARE GOING TO LEARNING ABOUT THE MONEY MARKET: This basically let's us understand how the money supply determines the interest rate

BONDS: What are bonds...

Well... Wealth is accumulated purchasing power, and wealth can be held in assets, or "things which you own" -This includes both money and "interest bearing assets"

Any household's financial portfolio includes a combination of money and interest bearing assets- choosing a different investment plan is just a matter of deciding how much of your wealth you wish to hold as money, and how much of it you wish to hold as an asset

Money has no risk of lost value (other than inflation), but also does not give you any returns as an investment

Interest bearing assets include bonds (IOUs from companies or the government), stocks (shares of control of a company) and other things (like real estate). They contain an element of risk, in that they can decrease in value over time and cause you to lose money, but on the other hand, they can generate returns (so you can profit off of investing of interest bearing assets if they increase in value)

TO SIMPLIFY OUR MODEL (for now) WE'RE GOING TO ASSUME THAT THERE ARE ONLY TWO KINDS OF ASSETS: MONEY & BONDS!

So.... Here's a chart

Money: Cash in circulation, as well as deposits held in checking accounts: it has no risk, and generates no returns

Bonds: All other forms of interest bearing assets: it has risk, but can also generate returns

Debt: An interest-earning financial asset: this is a synonym for a bond: when you are a creditor, loaning money to a company, you are effectively buying a debt. There is some risk involved (because there is a chance that the company will go bankrupt and be unable to pay back the loan), but there is also a guaranteed rate of return, as determined by the bond agreement.

Equity: Claims on real capital: This describes stocks, which are a "gift" to companies. Companies may pay dividends to stockholders, but there is no guarantee of this.

BOND TERMINOLOGY: This is dense, awful stuff, so get ready

A BOND: A financial contract to pay fixed amounts at future specified dates, and to repay the principal (a loan agreement or a debt are both synonyms for bonds)

A DEBTOR: A borrower, or someone who sells bonds

A CREDITOR: A lender, or someone who buys bonds

THE INTIAL PRICE OF THE BOND: The original loan value or face value of the bond (ie: the principal)

A COUPON: The dollar value of the fixed returns on the bond

THE COUPON YIELD: Coupon / Initial Price (so, if the bond was valued at $100, and the coupon was $10 for a one-year loan, the coupon yield would be 10%, because 10/100 = 0.10

Initial Price * Coupon Yield = Coupon

100 * 10% = $10 Coupon!

PRICE OF THE BOND (Pb): Originally, this is the face value, or principal of the bond, BUT once the bond is sold, it is the present value of the bond in the market (so the price of the bond can change depending on market conditions)

PRESENT VALUE (PV): A discounted value of all future expected income streams using the MARKET RATE OF INTEREST (the discount rate). The price of the bond which a buyer is willing to pay to receive a future income stream provided by a bond

BOND YIELD: How much money you will make off of the bond- this is determined by a combination of the coupon, plus capital gain (as bonds are a form of asset, and can gain value depending on market conditions)

MARKET YIELD (i): The 'average' interest rate in all money-bearing assets currently in a market: the time-sensative value of money (in other words, the minimum rate on interest which you would impose on debtors to loan them money)

TERM (t): The time it takes to completely pay off a bond (principal and coupons)

JUNK BOND: A riskier, high-yield bond (BBB)

Basic ideas:

-The Present Value is equal to the Price of the Bond, which is equal to the face value of the bond at the time of issuance if the market rate of interest is equal to the coupon yield (which it usually is), because the present value, if you use the market rate, will be the face value

-The Present Value is equal to the Price of the Bond, which is equal to Face Value of the bond at maturity, because the bond has no return at that point: just principal

-As a lender, returns higher than those for the market rate are desirable

Note*

There are 3 yields (or rates of return, or interest rates)

-The coupon yield (which is guaranteed, according to the bond agreement)

-The bond yield (which can change depending on market conditions)

The market yield (which is the interest rate of money-bearing assets currently in a market): generally, coupon yields for bonds are set at the market rate for the time when they are issued

demand for money is a function of the NOMINAL rate of interest

Three cases where bonds are sold

Case 1: The bond is price "at par"

Case 2: The bond is sold at a discount (it is worth less in the market than it's face value, so it is sold for less than its face value

Case 3: The bond is sold at a premium (it is worth more in the market than it's face value, so it is sold for more than its face value)

Interest rates affect the present market value of bonds.

The price of bonds varies inversely with interest rates!

R = return one year hence

i = annual market rate of interest (sometimes called the discount rate)

PV = Present value

PV = R/(1 + i)

PV = R/(1 + i)-exponent t (where t is the number of years in the future)

So if the return on a bond one year hence is $110, and the interest rate is 3%, then

PV = 110/(1.03)

PV = $106.80

If the return on a bond is $120 in two years and the interest rate is 10%, then

PV = 120/(1.10)^2

PV = $99.17

The price of a bond is the present value of that future income stream

-The buyer will not pay more than PV for the bond, and the seller will not sell it for less than PV

-The higher the interest rate, the lower the present value of the bond, and vice versa, in order to keep the coupon yield equal to the market interest rate. Basically, we just always fiddle with the present value to make the bond yield equal to the market interest rate (or simply "the" interest rate)

Pb * Bond Yield = Coupon

On most bonds, only the coupon yield is constant.

So, with a given face value, or original bond price of $100, and an original market interest rate of 10%, the issuer of the bond (the borrower) will offer a coupon of $10, or a coupon rate of 10% to compete in the market. This means that the coupon will be $10

Coupon yield = Coupon/Face Value

10/100 = 0.10 = 10%

Bond Yield = The market rate of interest, so there is no capital gain initially...

BUT

let's say that the market interest rate jumps to 20%

The present value of the bond falls to around $60

The price of the bond falls to around $60

-The bond yield (including the present value of future payments + capital gain as the bond approaches maturity) rises to market interest rates of 20%

That's all for today!

BONDS: What are bonds...

Well... Wealth is accumulated purchasing power, and wealth can be held in assets, or "things which you own" -This includes both money and "interest bearing assets"

Any household's financial portfolio includes a combination of money and interest bearing assets- choosing a different investment plan is just a matter of deciding how much of your wealth you wish to hold as money, and how much of it you wish to hold as an asset

Money has no risk of lost value (other than inflation), but also does not give you any returns as an investment

Interest bearing assets include bonds (IOUs from companies or the government), stocks (shares of control of a company) and other things (like real estate). They contain an element of risk, in that they can decrease in value over time and cause you to lose money, but on the other hand, they can generate returns (so you can profit off of investing of interest bearing assets if they increase in value)

TO SIMPLIFY OUR MODEL (for now) WE'RE GOING TO ASSUME THAT THERE ARE ONLY TWO KINDS OF ASSETS: MONEY & BONDS!

So.... Here's a chart

Money: Cash in circulation, as well as deposits held in checking accounts: it has no risk, and generates no returns

Bonds: All other forms of interest bearing assets: it has risk, but can also generate returns

Debt: An interest-earning financial asset: this is a synonym for a bond: when you are a creditor, loaning money to a company, you are effectively buying a debt. There is some risk involved (because there is a chance that the company will go bankrupt and be unable to pay back the loan), but there is also a guaranteed rate of return, as determined by the bond agreement.

Equity: Claims on real capital: This describes stocks, which are a "gift" to companies. Companies may pay dividends to stockholders, but there is no guarantee of this.

BOND TERMINOLOGY: This is dense, awful stuff, so get ready